Free Money August 13, 2011

Posted by The Synaptic Gap in Uncategorized.Tags: aging population, baby boomers, capital, debt, demographics, economy, free money, interest rate, investment, leveraging, retirement, return, saving

add a comment

On August 9, 2011 the United States Federal Reserve announced that its key funds interest rate would be held at an historic low of 0% – .25% until at least mid-2013. This unprecedented move is both an indicator of the slow pace of growth the Fed now believes will define the US economy over the next two years as well as an attempt to calm market jitters by adding a drop of certainty into an otherwise stormy sea. This is welcome news to anyone who holds debt, such as a variable rate mortgage, or who holds investments or is looking to invest. One obvious way to benefit from this news is to pick up shares of Real Estate Investment Trusts (REITs) who are currently making outsized returns by borrowing in the short-term at very low rates and lending those funds out to longer-term high-yielding mortgage securities, such as American Capital Agency (NYSE: AGNC), Annaly Capital (NYSE: NLY), Chimera (NYSE: CIM) or Hatteras Financial (NYSE: HTS). Some investors have been holding out on these REITs given the likelihood of lowered profits with rising interest rates. Now that the Fed has guaranteed low rates for at least two more years, the 15% – 20% dividends of these companies will continue for some time.

But what should investors with a medium and long-term horizon do? Are western nations experiencing a short-term bump in the economic road, or is a fundamental economic shift underway? After decades of borrowing to maintain extraordinarily high standards of living, will the US eventually return to a high-growth, high interest rate environment, or should we expect low interest rates for the next 5-10 years and beyond? These diverging paths will have a significant impact on investment choices. In a prolonged period of low interest de-leveraging, a contrarian investor will want to borrow and leverage to take advantage of what is, essentially, free money. However, if rates rebound in an inflationary environment, being highly leveraged could be devastating. What to do?

The key factor is whether one believes the growth rate of the US economy will rebound anytime soon. Currently, a number of economists believe that the US is heading into a second recession. This is because after decades of borrowing too much, and crashing in 2008, the US government (and the Federal Reserve) tried to kick-start the economy by feeding it the same poison that led to the crash in the first place: debt. When the private sector tried to de-leverage, the public sector rang up massive spending and deficits to prevent the inevitable. But the American people wouldn’t have it. In the end, the deficit spending failed to achieve the objective of kick-starting the economy and caused recent financial panic when the US federal debt ceiling needed to be raised…again. Now, the government and the Fed are stepping back and letting the US economy correct itself, and that is going to take time – years – at a minimum.

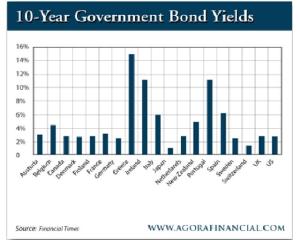

In the meantime, all of that government debt accumulated in the west must be paid off, which is going to be difficult to do in a slow-growing economic environment. The US is not alone on this front: The Greek government is eventually going to default on its debt – possibly Ireland and Portugal as well. Investors are driving up the returns these governments must pay on their bonds to compensate for the risk of default (see chart reproduced below from Agora Financial). This leads to a vicious cycle as debt payments eat up a larger percentage of tax revenues. Once debt-to-GDP ratios surpass 100%, it is usually just a matter of time before governments default. Currently, the USA, Portugal, Ireland, Belgium, Singapore, Italy, Iceland, Jamaica, Greece, Zimbabwe, and Lebanon have debt-to-GDP ratios of more than 100%. But Japan is the hands-down winner when it comes to debt as a percent of GDP, at over 225%.

As the ratio of debt-to-GDP grows, confidence in a government’s ability to pay back the debt falls, raising the rate of interest it must pay on that debt. Or, maybe not? Take a look at the chart again – notice anything odd? The country with the largest debt-to-GDP ratio in the world, Japan, also pays the lowest interest rates on its government bonds – approximately 1%. Investors are happy to accept a near zero return from the Japanese government even though it has the greatest debt burden of any nation on earth. What gives here?

Japan is, after Monaco, the oldest nation on earth, with a median age of 44.6. For comparison purposes, the median age of all the world’s population is 28.4. As a general rule, the older one gets, the more likely one is to retire. To retire, one must have some sort of savings or pension to live off. And the elderly who are living off of savings tend to put those savings in very low-risk investments. Could the extraordinary confluence of Japan’s very high debt-to-GDP ratio and its very low government bond yield be the result of the classic economic law of supply and demand? Are there so many elderly and retired individuals in Japan seeking a low-risk stable investment that the government finds itself in the enviable position of being cash-flush? It is not unusual for any nationality to buy into its own government bonds as a source of “pride” even though better returns may be found elsewhere. For example, according to http://www.economicshelp.org/blog/economics/list-of-national-debt-by-country/ 90% of Japanese debt is owned by Japanese individuals. Could the Japanese be supporting their government despite the extraordinarily low returns? If this hypothesis is true, what should we expect from other nations that are aging? And what of the baby-boomers in North America? How will the aging and retirement of this massive cohort influence demand for “safe” government and corporate bonds? And what will this mean for interest rates long-term?

Is it possible that North America, driven by aging baby-boomers, is entering a long-term low interest rate environment where excess cash seeks low-risk, stable investments? If that is true, younger investors may wish to position themselves to leverage as much of this “free money” as possible. This can be done by allocating capital into stable, dividend-paying opportunities in faster growing economies or new technologies. Historically low mortgage rates offer one opportunity. I know of people in Canada who have been able to secure a variable rate mortgage at Prime – .85%, which, at one point, translated into an effective interest rate of 1.4%. That is about as close to free money as you will ever get.

Full disclosure: The author owns shares of Annaly Capital

Unemployment Solution? July 12, 2011

Posted by The Synaptic Gap in Uncategorized.Tags: academia, academic, baby, boomer, brain, drain, economy, education, help, job, jobless, market, mcdonalds, post, retirement, secondary, unemployed, unemployment

1 comment so far

Recently, I spent the Easter weekend visiting my parents in small-town Ontario, Canada. My father, a hard-working 79-year-old who lived through the great depression, didn’t mince words: “What are you doing for money?” he asked. “I am retired” was my off-the-cuff remark. He laughed a nervous type of “Is he serious?” laugh.

Over the past couple of weeks, I have been thinking about that flippant response, and it is making more sense as the best logical solution to my current situation. What situation, you may wonder? I am in my mid-thirties, have a PhD in Psychology, have a 16-page curriculum vita, 10 years research and real estate management experience, and cannot find a job. Over the past 8 months, I have applied to over 120 positions all over the globe, and have even managed to secure 5 phone interviews. In some cases, I have lost the position to another older and more experienced candidate. Such is the state of the academic, and, I presume, overall job market.

To be fair, people run institutions, and most of those people are understanding and compassionate about the current state of affairs. For example, this is the email response I received from one academic institution in the US:

I am writing to inform you that the assistant professor position in psychology at _________ College has been filled. You probably do not care to hear anything more than this, but for what it is worth I wanted to give you some feedback about the search that we conducted as some of you may find it useful. We received about 40 applications for the position, and I can honestly say that there was not a single applicant for the position who was unqualified. As I am sure you know, the job market right now is flooded with a lot of very good people…The first offer that we made to one of these candidates was accepted. Many applicants with good credentials did not make the final cut for reasons that had nothing to do with quality…I wish you the very best in your search for a faculty position.

Nice touch, thanks for the clarification Dr. Obvious. Don’t get me wrong – I am not looking for handouts or pity. I am doing relatively well, thanks to the generous support of family and friends. I cannot imagine the hardship someone without such strong support would have to endure. Instead, and always the busy-body, I have been applying my academic training to try and sort out what is going on out there, and am motivated to share my thoughts with the many others who are likely in the same situation.

So here is what I have figured out so far. First, those of us who were unlucky enough to be born after the baby boomers – what I call the GAP generation – have had a particularly tough go of it. The baby boomers have been hoarding jobs and driving the social agenda for decades, and will continue to do so. Many of them didn’t plan for their retirement or planned way too late, instead voting in governments who promised the biggest payouts. Since the global economic crash, those who had the wherewithal to actually save some money have seen their retirement portfolios hit hard, and now they literally can’t retire. Who can blame them?

Second, those of us who were unlucky enough to choose higher academia as a career option are getting screwed. The entire post-secondary education system is a ponzi scheme that makes Bernie Madoff look like Mother Teresa and is mostly purgatory for the growing number of youth who don’t have anything to do and can’t find jobs. The powers-that-be are scared to death that these youth, if not kept busy, will take their heads, so they build post-secondary institutions and hand out student loans and tell the populace that they must have diplomas and degrees and graduate degrees to compete in global job market. Bullshit. Stuff that took a month of on-the-job training now requires a 3-year college course. The Ontario government, for example, recently implemented a policy that will increase the number of PhD’s graduating from the province’s institutions. Around the same time, mandatory retirement for existing professors was eliminated. Finally, Colleges and Universities have been squeezed to produce more with less, and the easiest way to cap costs is to hire course instructors instead of full-time faculty, further pinching the job market. As an aside, around the same time, opposition parties and the public complained about the number of Ontario students earning higher degrees and then leaving the country – the dreaded “brain drain”. The contradictory nature of government policies never ceases to amaze me.

Third, easy-money policies orchestrated by Western governments and central banks over the past 40 years have resulted in scary social debts and obligations that will need to be paid off, and I am pretty sure the baby boom generation will not be the ones who pay it. Since the 2007-08 economic crash, unemployment in the US has topped 10%, and even though Canada was not hit nearly as hard, a hiring freeze was immediately instituted across the public and private sectors in 2008. Since then, the US has printed billions of dollars to try and kick-start the economy, essentially adding more fuel – debt – to the fire that caused the crash in the first place – debt! They say it is working – the unemployment rate is going down, but most of the improvement has been made by taking people who can’t find a job off the list! But that’s what they do. If you don’t find a job in a certain amount of time, they figure you’ve given up and that you magically no longer need a job (and money) to live. But now, you are worse off – part of the long-term unemployed who lose the habit of working and whose skills become rusty – meaning employers are reluctant to take you back. To give you an idea of how many people are looking for work, McDonald’s just hired 68,000 employees in the US in April. That may sound great, but hidden within that victory is this number: McDonald’s turned away 932,000 applicants!

This means that over 0.32% of the entire population of the United States applied for a job at McDonald’s on April 19th. For those who are working, the law of supply-and-demand means their wages are flat and falling when inflation is factored in. Given the monumental US debt loads, the central bank will continue printing money to reduce the value of those debts, driving inflation higher. It recently cost me $92 to fill my car with fuel. It cost me $60 a couple of months ago. Working for a set wage is a sucker’s game. I’ll pass, thanks.

Nope, the only logical choice right now is retirement. Live a life of leisure and wait for those pesky baby-boomers to die off from coronaries and cancer. For those who do make it to old age, there’s always dementia. They will need 24-7 care, which should create lots of jobs, and God knows they have the money to pay for it. In the meantime, I will enjoy my youthful retirement, as the greatest transfer of generational wealth in history unfolds before us and wealth between the West and the East becomes more balanced. Maybe my career will launch in 10-15 years, and I will then work until the day I die. After mulling it over for a little while I had become comfortable with this idea. Then, an esteemed colleague shattered my newly found comfortable reality. When the baby-boomers do finally retire or die off, perhaps employers will simply skip over a generation and hire younger, more energetic workers. Perhaps the GAP generation will disappear from the radar entirely. If that does come to pass, you will find me on the golf course.

Hello world! April 20, 2011

Posted by The Synaptic Gap in Uncategorized.1 comment so far

Welcome to WordPress.com. After you read this, you should delete and write your own post, with a new title above. Or hit Add New on the left (of the admin dashboard) to start a fresh post.

Here are some suggestions for your first post.

- You can find new ideas for what to blog about by reading the Daily Post.

- Add PressThis to your browser. It creates a new blog post for you about any interesting page you read on the web.

- Make some changes to this page, and then hit preview on the right. You can alway preview any post or edit you before you share it to the world.